- Home

- Todays Market

- Indian Stock Market News December 12, 2016

Indian Share Markets Open Weak; Oil Prices Soar on OPEC Deal Mon, 12 Dec 09:30 am

Asian markets are lower today as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.77%, while the Hang Seng is down 1.10%. The Shanghai Composite is trading down by 1.70%. Stock markets in the US and Europe closed their previous session in the green.

Meanwhile, Indian share markets have opened the day on a negative note. The BSE Sensex is trading lower by 139 points while the NSE Nifty is trading lower by 47 points. The BSE Mid Cap index opened down by 0.4% and BSE Small Cap index opened down by 0.1%. The rupee is trading at 67.58 to the US$.

Barring PSU and infrastructure stocks all sectoral indices have opened the day on a negative note with banking and information technology stocks witnessing maximum brunt.

As per an article in The Business Standard, State Bank of India (SBI) will sell off 3.9% of its stake in insurance arm SBI Life Insurance Company to global investment firms KKR and Temasek for Rs 17.9 billion (US$264 million). The bank received approval from the Executive Committee of the Central Board to divest 3,90,00,000 equity shares of the life insurance subsidiary at a price of Rs 460 per share.

The move comes ahead of its plans to go public within a couple of years. Both the partners will pick up equal stake in SBI Life Insurance, after HDFC Life (post-merger with Max Life) and ICICI Prudential Life. After the sale, SBI's stake in the insurer will decline to 70.1% from 74%. Its joint venture partner, BNP Paribas Cardiff, will continue to hold a 26% stake in the company.

Reportedly, with this proposed transaction, SBI Life Insurance would be valued at Rs 460 billion. Moreover, an investment vehicle affiliated with the KKR-managed funds and an affiliate of Temasek would each purchase 19.5 million shares from the bank.

India is the 10th largest life insurance market globally and has a large unpenetrated insurance market. Thus, it is believed to be one of the leading growth sectors in India. Further, as the sector is opening up for retail participation by way of IPOs, what should be one's approach towards such IPOs? Here is the answer...

Equitymaster's Handbook of IPO Investing (with special focus on never before Insurance IPOs) Click here to get your free copy right away...

Moving on to the news from

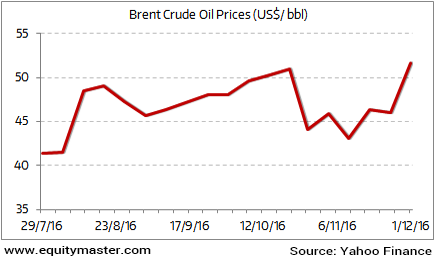

Reportedly, Brent crude futures, the international benchmark for oil prices, soared to US$57.89 per barrel (bpd) in overnight trading between Sunday and Monday. Oil prices have crossed its highest level since July 2015. Meanwhile, U.S. West Texas Intermediate (WTI) crude futures also hit a July 2015 high of US$54.51 a barrel.

Crude Prices on the Rise Again

The gains are being driven by an agreement from non-OPEC crude producers, including Russia to cut production levels by 558,000 barrels per day, or around 0.6% of global supply. The move came following the 1.2 million barrels per day reduction announced by OPEC at the group's November 30 meeting.

Russia agreed to a 300k bpd reduction and Mexico, which previously bristled at the deal said it would cut by 100k bpd.

Notably, OPEC has said it will slash output by 1.2 million barrels per day from January 2017. In a bid to end overproduction that has dogged markets for over two years and pushed the economies of many oil exporting countries into crisis, Saudi Arabia will also cut around 486,000 bpd.

However, this is bad news for the Indian economy. Ever since June 2014, the Modi government has received a huge tailwind from falling crude prices. It captured most of the gain by raising excise duties on petroleum products multiple times.

Crude oil prices are rising again. What happens now? We believe, this will have a pass through effect on inflation. When consumer spending normalises post demonetisation, we should all be on our guard for rising inflation.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Share Markets Open Weak; Oil Prices Soar on OPEC Deal". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!