- Home

- Todays Market

- Indian Stock Market News May 16, 2017

Sensex, Nifty Close at Record Highs; IT Stocks Lead Gains Tue, 16 May Closing

After opening the day on a positive note, share markets in India continued to scale new heights and ended the day on a record high. Gains were largely seen in the software sectors, telecom sector and consumer durables sector, while stocks in the metals sector ended the day in red.

At the closing bell, the BSE Sensex stood higher by 260 points (up 0.9%) and the NSE Nifty closed higher by 66 points (up 0.7%). The BSE Mid Cap index ended the day up by 0.3%, while the BSE Small Cap index ended the day up by 0.4%.

Asian stock markets finished mixed as of the most recent closing prices. The Hang Seng dropped 0.14% and the Nikkei gained 0.25%. The Shanghai Composite gained 0.74%. European markets too are trading mixed today. The FTSE 100 is up 0.59% while Germany's DAX is trading flat and France's CAC 40 is down 0.29%. The rupee was trading at 64.09 to the US$ at the time of writing.

In news from stocks in the banking sector. Punjab National Bank (PNB) share price went up by 4.6% in today's trade after the bank reported a profitable quarter.

PNB reported a net profit of Rs. 2,620 million for the fourth quarter ended March 31, 2017 against a net loss of Rs 5,370 million in the same quarter last fiscal.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The reversal of fortunes came on the back of healthy growth in net interest income, other income, operating income and asset quality improvement, despite rising provisions.

Net interest income, grew by 33.1% year-on-year (YoY) to Rs 36.8 billion for the January-March quarter despite slow loan growth of 1.7%.

Gross non-performing assets (NPAs) fell 0.8% to Rs 553.7 billion at the end of the March quarter compared to a year ago. The bank reported gross NPA of Rs 556.3 crore a quarter ago.

As a percentage of total loans, gross NPAs stood at 12.5% at the end of the March 2017 quarter compared with 13.7% in the previous quarter and 12.9% in the year-ago quarter. Net NPAs were at 7.81% compared with 9.09% in the previous quarter and 8.61% in the same quarter last year.

India is going through a severe bad loan problem. Major banks have reported poor numbers in the recent earnings season.

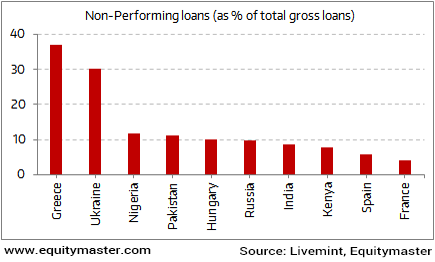

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

India is Near the Bottom of the Global NPA List

Out of the ten major economies facing NPA problems, India is ranked seventh.

The overhang of bad debts has not only hit the bank's profitability, but has also restricted their loan book growth.

The current push by the government and the RBI to remedy the NPA crisis would go a long way to solve the crisis the country's lenders now find themselves in.

A significant reduction in the number of NPAs will help banks grant new loans and spur the investment cycle. Effectively pushing India's GDP growth.

So how can one take advantage of this opportunity?

We believe a few super investors could provide the clue. These are the guys who've beaten the markets black and blue and have an eye for multi bagger stocks irrespective of the macro environment.

With respect to which super investors to follow, our Research analysts Kunal and Rohan have could be of great help courtesy their project, The Superinvestors of India.

To know more about these superinvestors and their stock picking approach, download a free copy of - The Super Investors Of India.

Moving on to news from stocks in the IT sector. TCS share price ended the day among the top gainers in anticipation of the Rs 160 billion buyback set to commence on 18 May.

The buyback programme, which received shareholder approval last month, will open on May 18 and close on May 31, the company said in a regulatory filing.

TCS will dispatch the Letter of Offer for the buyback to eligible shareholders on or before May 16, it added.

The share buyback will be India's biggest, surpassing

Share buybacks typically improve earnings per share and return surplus cash to shareholders while also supporting share price during periods of sluggish market condition.

TCS has a cash pile of over Rs 430 billion, which is nearly 10% of the company's market capitalisation.

Indian IT companies have been under pressure to return excess cash on their books to shareholders through generous dividends and buybacks.

The proposed buyback represents over 2.85% of the total paid-up capital at Rs 2,850 per share.

TCS' rivals Infosys and HCL Tech to have announced similar buyback plans. While Infosys has allocated over Rs 130 billion to be returned to shareholders through buybacks and dividends this year, HCL Tech has already approved a buyback wort Rs 35 billion.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex, Nifty Close at Record Highs; IT Stocks Lead Gains". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!