- Home

- Todays Market

- Indian Stock Market News May 5, 2017

Sensex Ends 267 Points Down as Metal & Energy Stocks Drag Fri, 5 May Closing

Share markets in India ended the day on a weak note amid a drop in crude prices. At the closing bell, the BSE Sensex closed lower by 267 points. While, the NSE Nifty finished lower by 75 points. The S&P BSE Midcap finished down by 1.1% while the S&P BSE Small Cap Index ended down by 0.8%.

Among BSE sectoral indices, metal stocks fell the most by 2.5%, followed by oil & gas sector and Infrastructure sector.

Asian stock markets finished mixed as the fresh falls in commodities raised concerns about the health of the global economy. The Nikkei 225 gained 0.70%, while the Hang Seng and the Shanghai Composite ended lower. They fell 0.84% and 0.78% respectively. While, European markets are mixed. The FTSE 100 is higher by 0.11%, while the DAX is leading the CAC 40 lower. They are down 0.36% and 0.14% respectively.

The rupee was trading at Rs 64.31 against the US$ in the afternoon session. Oil prices were trading at US$ 45.66 at the time of writing.

Bank stocks dipped with Nifty Bank index falling 1.7% after the government notified the ordinance that seeks to tackle non-performing loans in the sector. Bank of India share price, Allahabad Bank share price, Bank of Baroda share price and Andhra Bank share price slipped anywhere between 4-5%.

Automobile stocks finished the day in red with only Escorts and Maharashtra Scooters witnessing buying interest. Tata Motors share price plunged as much as 3.8% to hit its lowest level since 30 May 2016. The scrip declined after Tata Motors' UK subsidiary Jaguar Land Rover (JLR), reported a drop in sales in the month of April 2017.

The UK's leading manufacturer of premium luxury vehicles reported April retail sales of 40,385, down 2.3% as against in April 2016. The company sold 219,891 vehicles in the first four months of 2017, up 9.9% compared to the same period a year ago.

In North America, Jaguar's retail sales increased 32.5%. In China and Europe, retail sales were up 10.1% and 2.7%, respectively. However, in the UK, sales were down 34.6% in April (y-o-y). Sales dropped 19.7% in other overseas markets.

The company attributed the decline in sales to two factors. In the UK, customers purchased vehicles before the increase in vehicle tax on 1st April. In addition, the run-out of the previous Discovery model accounted for a year-on-year decrease in Land Rover sales.

To know more about the company's financial performance, subscribers can access Tata Motor's latest result analysis and Tata Motors stock analysis on our website.

Moving on to news from the economy. Indian oil explorers fell today on weaker crude oil prices, with ONGC share price and Oil India share price declining more than 2% each. But oil refiners and airlines stocks rose with Indian Oil Corp share price climbed intraday by 2.1% while Spicejet Ltd share price settled over 4.5% higher. Weak oil prices result in higher margins for domestic refiners and airline companies.

Oil prices fell by as much as a further 3% today, after prices had crashed to five-month lows in the previous session, as concerns about global oversupply wiped out all of the price gains since OPEC's move to cut output.

Brent crude futures, the international benchmark for oil prices, were at US$48 per barrel after tumbling back below US$50 a barrel on Thursday. Crude prices are now back to levels last seen before the OPEC and other producers said they would cut output by almost 1.8 million barrels per day (bpd) during the first half of the year in a bid to tighten the market.

The oil-producers' bloc had in November last year agreed on first oil output cut in eight years. This had led to a rally in oil prices but encouraged US drillers to pump more.

For the Indian economy, the crude price fall comes as a positive development. Since India imports nearly three-fourth of its oil requirements, the immediate impact would be a drop in imported inflation.

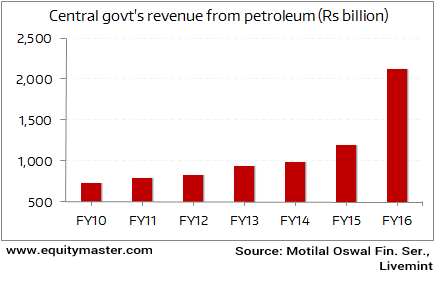

The government's windfall from the crude price plunge

One must note that, even as prices have been falling rapidly, not all of this has been passed on to the Indian consumer. The government has been quick to repeatedly hike excise taxes on petroleum products. Vivek Kaul wrote about how lower oil prices were of huge benefit to the government in his Diary recently. Here's Vivek:

- "Interestingly, it even touched a low of $26.95 per barrel on February 12, earlier this year. This was a massive fall of 75%. The point being if this hadn't happened, the finances of the Modi government would have gone for a toss totally. The petroleum subsidy number fell from Rs 92,000 crore in 2013-2014, to a little over Rs 60,000 crore in 2014-2015, to around Rs 30,000 crore in 2015-2016. For 2016-2017, around Rs 27,000 crore has been budgeted for the petroleum subsidy."

However, for Indian consumers, a drop in global crude prices means lower fuel prices at the pumps. Apart from global crude prices, the value of the rupee against the dollar also determines the domestic cost of petrol and diesel at the fuel stations.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 267 Points Down as Metal & Energy Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!