- Home

- Outlook Arena

- How to Find Undervalued Stocks

How to Find Undervalued Stocks

Revealing on April 30: Are You Ready for the Upcoming Election Surprise?

Back in January 2018, Wonderla Holidays Ltd, one of India's largest amusement park companies, was trading at a steep price to earnings ratio of more than 50x.

The company was run by a management with a stellar reputation. IT had a rock solid balance sheet.

But investors were pinning too much hope on strong growth in earnings to justify the high valuations.

What transpired next was pretty interesting.

The company did record growth in earnings over the next couple of years.

But the stock price crashed by almost 40%.

There was more bad news in store.

All hell broke loose when the Coronavirus pandemic spread across the world. The company's stock price fell another 50% in the next few months alone.

Thus, from its highs, the stock fell a whopping 75%. This crash destroyed a huge amount of wealth of its investors.

As compared to January 2018, the valuations of the stock turned far more reasonable. The stock now traded at a single digit multiple of around 9x, with its balance sheet strength pretty much intact.

Thus, at its multi-year lows, the stock made for a good medium to long-term bet with the risk-reward ratio now firmly in favour of the investor.

Well, anyone who would have invested in the stock back in April-May 2020 would have gone laughing to the bank. The stock has almost double since then. It's looking good for even more gains from here on.

Consider another example where we cover two companies viz. HUL and Care Ratings and their journey in the strong market rally following the March 2020 crash.

HUL is the more famous of the two. It traded at a huge price to earnings multiple of more than 70x at the end of March 2020. This seemed to be on the higher side despite the company's impeccable reputation of being the bluest of the blue chips.

Care Ratings is a stock not as pedigreed as HUL. However, it's a good company, nevertheless. It had fallen to a price to earnings multiple of just 8x-9x.

There was a huge difference in the qualitative parameters of the two companies. However, Care Ratings trading at a single digit price to earnings multiple definitely seemed like a better bet.

This has proved to be correct. HUL's price has been almost flat in the eight months that followed. CARE Ratings on the other hand, is up a cool 73% and is far from finished yet.

The Power of Undervalued Stocks

These two case studies are great examples of the power of investing in undervalued stocks.

Wonderla Holidays investors made huge losses when it was significantly overvalued.

Those investors made huge money on the very same stock when it turned significantly undervalued.

The second example was a textbook case of how a good stock does not always make for a good investment.

HUL, a much better quality stock, gave poorer returns than CARE Ratings.

Little wonder, investors are constantly on the lookout for most undervalued stocks. They consider the stock's valuation as one of the most important factors in their stock picking.

The Two Big Dilemmas

This brings us to a couple of very important questions.

Does every stock have a fair value below which a stock becomes undervalued and above which it becomes overvalued?

Do all undervalued stocks go on to give good returns over a 2-3 year period?

The answer to the first question would be a Yes as well as a No.

There indeed exists a fair value or what is also known as an intrinsic value for a company.

However, if Ben Graham the father of value investing is to be believed, the intrinsic or the fair value of the company is an important but an elusive concept.

Important because if one knows the intrinsic value of a company, one can get an idea of its valuation.

However, it is also elusive. There is no rule which says the intrinsic value should be arrived at using book value or earnings or dividends for that matter.

Each investor will have its own interpretation of the intrinsic value based on the parameters and the valuation multiples he chooses to use.

Second, there is no consensus on which earnings to use while calculating the intrinsic value.

Is it the past earnings or present earnings? Is it the average of the past 5 years or the past 3 years?

All sorts of subjective elements can creep into the calculation of intrinsic value. This can leave investors confused.

In this video you can learn more...

The Big Ray of Hope

But all is not lost.

You don't need to determine the exact intrinsic value of the company to invest in undervalued stocks.

We only need to know if the value is in the right ballpark or if it is considerably higher or lower than the market price.

It was quite evident that the value of Wonderla Holidays was quite lower than its price to earnings multiple of 55x back in 2018.

And it was also quite evident that its value was much higher than the multiple of 9x it had come down to.

In both these examples, there was no need to arrive at the precise fair value or the intrinsic value of the company.

Thus, we can take a look at the past performance of a company and get a sense of its approximate intrinsic value.

Once this is done, it is easy to dig deeper into the stocks that seem to be undervalued and are trading at a sizeable discount to their intrinsic values.

This brings me to the second question. Do all undervalued stocks give good returns over a 2-3 year period?

No, certainly not.

Success in investing depends on how the future pans out and that is not predictable.

A stock may look undervalued based on its past performance. However, if the future developments are of an opposite kind, it may render the past completely meaningless.

Thus, not every undervalued stock may not turn out to be a good investment but it is a great place to start looking for one.

Undervaluation a Key Factor in Shortlisting Stocks for Investment

We have seen the power of investing in the right undervalued stock at the right time.

A lot of investors prefer to put together a list of most undervalued stocks.

They then buy the ones that satisfy all their other criteria as well.

One criterion that has shown some great results in the past is stocks that are undervalued on the basis of book value. These are stocks trading at a discount of at least 20% to their latest book values.

Buying a stock at a 20% discount to the book value is like buying a Rs 100 note at Rs 80 or below.

Thus, if the company has a strong balance sheet and a reasonably long history of making profits, then there's a strong chance that a group of 20-30 stocks can give good returns over the next 1-2 years.

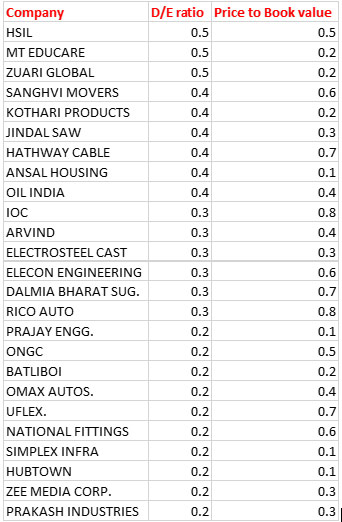

Here's a list of 25 Indian undervalued stocks with P/BV less than 0.8 and debt that's well below equity screened from the Equitymaster website.

Data as of December 2020

After doing some further research, you will be able to choose few undervalued stocks that will go on give good returns over the next couple of years.

Before we conclude, let us remind you that investment is an operation that upon thorough analysis promises safety of principal and an adequate return.

Thus, what better way to ensure safety of principle than by buying undervalued stocks that also holds the promise of an adequate return.

Here are Links to Some Very Insightful Equitymaster Articles and Videos on Investing in Undervalued Stocks

- Best Stocks to Buy Today

- Basics of Value Investing

- Here's How to be 'Aatma Nirbhar' in Picking the Best Stocks

- The Wealth-Building Secret that Forced a 180-Degree Shift in my Stock Picking