- Home

- Todays Market

- Indian Stock Market News February 17, 2017

Sensex Continues Momentum; Banking Sector Witnesses Buying Fri, 17 Feb 11:30 am

After opening the day on a positive note, the Indian share markets have continued their momentum and are presently trading in the green. Sectoral indices are trading on a mixed note with stocks in the banking sector and healthcare sector witnessing maximum buying interest. IT stocks are trading in the red.

The BSE Sensex is trading up 212 points (up 0.8%) and the NSE Nifty is trading up 50 points (up 0.6%). The BSE Mid Cap index is trading up by 0.5%, while the BSE Small Cap index is trading up by 0.6%. The rupee is trading at 67.03 to the US$.

HDFC Bank share price surged 8% in opening trade after it was reported that Reserve Bank of India removed restrictions on foreign institutional investors for the purchase of shares of the lender with immediate effect.

In the news from global financial markets, Japan's economy expanded at a steadily slowing pace during the last three months of 2016. Data released showed Japan's GDP grew at an annualised 1% in October-December. The preliminary reading for fourth-quarter GDP figure translated into 0.2% growth on a quarter-on-quarter basis.

Claim This Report Now. Hurry!

In this report, we reveal an easy-to-implement four step process that could boost your trading profits.

If you act right now, you can download it FREE.

Go ahead, grab your copy today. This is a limited period opportunity

Please read our Terms Of Use.

As per the data, a weaker yen supported exports of the country. However, tepid private consumption and the risks of rising US protectionism continued to weigh on a sustainable recovery.

External demand contributed 0.2% point to GDP, with exports rising 2.6%. This was the fastest growth in two years and was largely driven by shipments of cars to China and the US, and those of electronics parts to Asia.

Private consumption, which accounts for roughly 60% of GDP, showed no growth. The data suggested that rising food prices dented households' purchasing power.

The Bank of Japan (BoJ) now sees real GDP growth of 1.5% in the 2017 fiscal year. This is up from its previous forecast of 1.3% offered in November last year.

We believe there's a big crisis brewing within Japan. In fact, if there's one place on this planet that epitomizes all the wrong kinds of growth, it's Japan. Too much money printing...too much debt...too much government intervention...too much stock market manipulation. Sooner than later, these easy money measures by central bank are going to end. And as per Asad, the end of easy money policies will create some big trends that traders can profit from.

Speaking of trading, our colleague Apurva Sheth of the Profit Hunter team released a detailed report on trading stocks. The special report talks about what he believes could be extremely effective stock trading strategy. Most importantly, the strategy could be implemented in four easy steps. Get your hands on this report right now.

In the news from domestic markets, Reserve Bank of India (RBI) Governor Urjit Patel has stated that India's growth will bounce back after a sharp slowdown triggered by government's notebandi.

The governor said that the benefits of the notebandi drive will take time to fully play out and need more work to ensure they're lasting. As per him, remonetisation has happened at a fast pace and that was part of the plan.

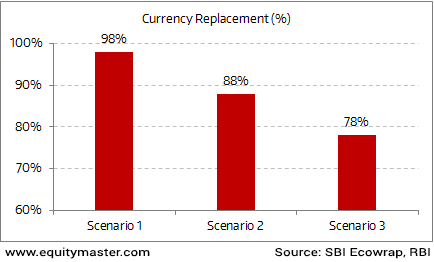

Notebandi: Expected Currency Replacement by Feb 2017

However, if one has to look at the data, re-monetisation is where things really fell apart.

According to an article in the Mint, as of January 2017, the total currency in circulation is 57% of what it was before notebandi. In fact, as per RBI data, the cash with public is 40% less than what it was one year ago.

So going by the ground realities, the economy is still facing troubles for the notebandi drive initiated by the government. The government will continue with its lies to tell us that all is well on the notebandi front, but that doesn't make the situation any better for the common man.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Continues Momentum; Banking Sector Witnesses Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!