- Home

- Todays Market

- Indian Stock Market News March 20, 2024

Sensex Today Ends Higher Ahead of Fed Outcome | Energy Stocks Rally | Metro Brands Zooms 20% Wed, 20 Mar Closing

Indian share markets were volatile throughout the trading session today.

After opening the day on a positive note, benchmark indices fell marginally only to recover in the afternoon session and ending on a positive note.

Sensex and Nifty rose today following a heavy selloff in the previous session.

The gains were led by a rebound in auto and energy stocks.

At the closing bell, the BSE Sensex stood higher by 89 points (up 0.2%).

Meanwhile, the NSE Nifty closed higher by 22 points (up 0.1%).

Maruti, Nestle India and SBI were among the top gainers today.

Tata Steel, Tata Motors and HDFC Bank, on the other hand, were among the top losers today.

The GIFT Nifty was trading at 21,903, up by 6 points, at the time of writing.

The BSE MidCap index and the BSE SmallCap index ended on a flat note.

Sectoral indices ended mixed with stocks in the energy sector, power sector and oil & gas sector witnessing most of the buying.

While IT, metal and finance stocks witnessed selling.

Shares of Sapphire Foods, Veritas and Maruti Suzuki hit their respective 52-week highs today.

The rupee is trading at 83.16 against the US$.

Gold prices for the latest contract on MCX are trading up by 0.1% at Rs 65,590 per 10 grams.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

----------------------------------------

Gold prices were stuck in a tight range as traders prepared for a key policy decision from the US Federal Reserve and remarks from Fed Chair Jerome Powell later in the day.

Speaking of stock markets, Tanushree Banerjee talks about semiconductor stocks in her latest video.

Tune in below for more:

JSW Group's Big EV Bet

In news from the electric vehicle space, the JSW Group and SAIC-owned MG Motor have formed a joint venture to manufacture new electric vehicles (NEVs) in India.

In fact, they already revealed plans to launch a new product including NEVs every three to six months beginning September with two new products to be launched this calendar year.

The JV, called JSW MG Motor India Pvt Ltd, aims to become a market leader in the NEV category with an extensive product portfolio.

The company will operate in Halol, Gujarat with a focus on producing NEVs. This will help ramp up MG's production capacity from 1 lakh to 3 lakh units per year.

The JV aim to sell 1 million electric vehicles in India by 2030, as disclosed by a JSW Group executive.

Note that this comes after India recently reduced import taxes on specific electric vehicles for carmakers investing at least US$500 million and starting domestic manufacturing within three years.

H2>Maruti Soars Past Rs 12,000 Mark

Maruti Suzuki share price crossed the Rs 12,000 mark today.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

What You Need to Know Before Investing in Small Businesses

Read this letter before you invest in small companies

Read Now

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

The sharp rally in India's largest carmaker comes after a brokerage firm highlighted that Maruti will maintain its top position in the CNG PV segment with a 72% share.

The note added that with rise in CNG passenger vehicles, Maruti Suzuki and Tata Motors will benefit.

In the most recent quarter, Maruti reported a net profit of Rs 31.3 bn, a 33% YoY increase from the previous fiscal.

Revenue for the same period also increased 15% to Rs 333.1 bn.

In recent months, M&M, TVS Motor, Maruti, Tata Motors - all these auto majors have touched their yearly highs not long ago with sentiment looking more bullish than ever.

The street is expecting higher sales going forward as India's economy improves and as people consider higher expenditure on luxury.

Data from the federation of automobile dealers shows that auto sales have touched record levels in the past few months.

In the case of Maruti, it was only a matter of time before India's largest car manufacturer wakes up from the underperformed in recent years. The underperformance resulted in Tata Motors racing past Maruti in marketcap race for the first time in seven years.

In the past one year, Maruti share price has gone up by around 27%.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

This Silvery-white Metal is a Potential Fortune Maker

This silvery-white metal goes inside almost all the electronic gadgets that you use: mobile phone, laptop, Bluetooth speakers.

Not only that... this metal also goes inside equipment used by large data centres, telecom towers, railways, planes, EVs.

We're talking about Lithium. Lithium is the new oil.

Our research has found the best way to tap into this rising demand of lithium in India.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Why LT Foods Share Price is Rising

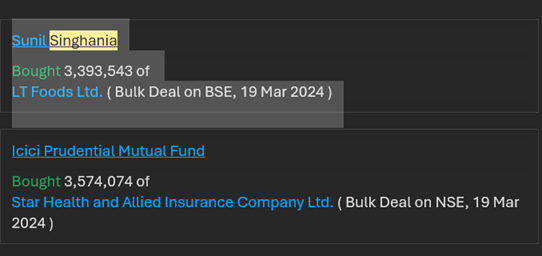

LT Foods share price rallied over 10% today after Sunil Singhania entered the stock via a bulk deal.

Bulk deal data revealed that the market mogul bought stake in the rice stock on Tuesday, 19 March 2024.

The transaction was carried out via the fund he manages Abakkus Fund.

In July 2023, the ace investor's PMS fund topped the list according to reports.

LT Foods commands a dominant market share in the industry, being the second-largest branded basmati rice player in India. It's also the largest selling basmati brand in the US with more than 50% market share in FY23.

Going forward, LT Foods plans to grow by expanding its footprint to new countries through its flagship brand Daawat.

Current trends such as higher spending capacity, increased in-house consumption and growing health awareness will support the company's expansion plans.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Ends Higher Ahead of Fed Outcome | Energy Stocks Rally | Metro Brands Zooms 20%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!