- Home

- Todays Market

- Indian Stock Market News September 29, 2017

Sensex Gives Away All Gains; FMCG Stocks Slump Fri, 29 Sep Closing

After opening the day strong, share markets in India witnessed selling pressure in the afternoon session and ended the day flat. Losses were seen across most sectors with stocks in the IT sector and stocks in the FMCG sector, leading the losses. While stocks in the realty sector witnessed buying interest.

At the closing bell, the BSE Sensex stood higher by 1 point and the NSE Nifty closed higher by 20 points (up 0.2%). The BSE Mid Cap index ended the day up by 0.8%, while the BSE Small Cap index ended the day up by 1.1%.

Asian stock markets finished higher amid a host of positive macroeconomic data. As of the most recent closing prices, the Hang Seng was higher marginally by 0.5% and the Shanghai Composite was up by 0.3%. The Nikkei 225 was flat European markets too were trading marginally in green. The FTSE was 100 up by 0.5%. The DAX was higher by 0.2% while the CAC 40 was flat.

The rupee was trading at Rs 65.29 against the US$ in the afternoon session. Oil prices were trading at US$ 51.55 at the time of writing.

In news about the economy. Market participants cheered the government's decision to stick to the fiscal deficit target.

The government announced that it will stick to its budgeted market borrowing target for the fiscal year ending in March 2018, but didn't rule out the possibility of selling additional bonds to fund any new spending.

The finance ministry on Thursday released borrowing calendar for the second half of FY18, indicating a gross borrowing of Rs 2.08 trillion, which is in line with the target laid out in the Budget.

The government said that it is in talks with The Reserve Bank of India (RBI) for additional dividend.In the last annual budget, the government had kept the target for gross market borrowings of Rs 5.8 trillion. Of this, Rs 3.7 trillion was raised in the first half of the year.

The government will also utilize additional funds from central public-sector enterprises (CPSEs), who will outlay capital expenditure of over Rs 3.7 trillion this financial year. An additional Rs 250 billion will be spent by CPSEs like the National Highways Authority of India and firms in sectors such as steel, power and petroleum.

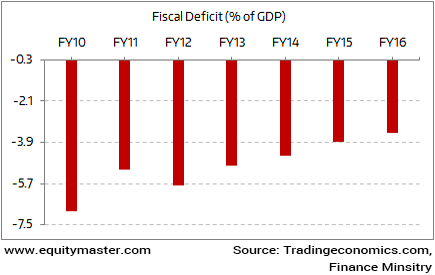

One of the important yardstick to measure the financial health of an economy is Fiscal deficit. It is the difference between the government revenues and expenditure. The difference is generally bridged by debt. The present government is committed to reduce the gap. The long term fiscal deficit target is 3% of the Gross domestic product (GDP). This simply means relatively less expenditure. Hence, less government spending.

Government Sticks to Fiscal Deficit target of 3% of GD

In last one decade India is making serious efforts to reduce the fiscal deficit level. Ever since, the new government came in it has been in favor of fiscal consolidation and meet the long term fiscal deficit target of 3% by FY17-18.

This means, once again, the government needs to fight dual challenge. First, maintaining its stance on fiscal consolidation and sticking it fiscal deficit target of 3% of GDP for FY17-18. Second, it must relax the deficit target for reviving the economy from the shock of demonetisation and the implementation of the goods and service tax (GST).

Moving on to news from stocks in the pharma sector. Cadila Healthcare share price closed the day on an encouraging note after the company received final approval from the US Food and Drug Administration (USFDA) to market doxycycline tablets. The tablets are used for treatment of different types of bacterial infections such as acne and eye infection.

The company will manufacture the drug at the group's formulations facility at the pharma SEZ in Ahmedabad.

It has more than 155 approvals and has so far filed over 300 abbreviated new drug applications (ANDAs) since it commenced filings in 2003-04

Cadila Healthcare share price closed the day up by 2.1%.

The Indian pharmaceutical industry has come under a lot of regulatory pressure in the past few years.

The sector has faced great volatility over the years.

We had written about the current predicament of Indian pharma companies in one of the premium editions of the 5 Minute WrapUp:

- Over the past few years, risk in the US markets has increased. The US Food and Drug Administration has become stricter on products entering US borders. Surprise inspections have increased and companies are being issued warning letters. This has impacted the business and earnings of Indian pharma players, causing major volatility for the sector.

The list of pharma sector woes is long. So, is there light at the end of the tunnel? Girish Shetty, our research analyst thinks there is.

As per him, it doesn't make sense to paint all pharma stocks with the same brush. The leaders of the industry will certainly survive this phase. There are interesting, niche pharma stocks that are worth your attention.

Facing pricing pressures in the domestic and export markets, currency fluctuations, as well as manufacturing issues related to their plant, there is a transformation happening in the overall sector as to how business is done and will be done in the future.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Gives Away All Gains; FMCG Stocks Slump". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!