- Home

- Outlook Arena

- Best Paper Stocks in India

Best Paper Stocks in India

The Indian paper industry accounts for 1.6% of the world’s production of paper and paperboard. The estimated turnover of the industry is Rs 700 bn with domestic market size of Rs 800 bn.

In India, of the total paper production, 40% is from hardwood and bamboo fiber while 30% is from agro waste other 30% from recycled material.

One of the biggest strengths of the paper industry in India is that it's well-connected to other sectors of the economy. The country's paper industry is closely tied to its agricultural and textile industries, which makes it possible for paper manufacturers to source their raw materials from within the country instead of importing them from abroad.

Another strength of India's paper industry is that many companies are able to produce their products domestically rather than import them from abroad. This helps to keep costs down for both consumers and producers alike.

According to industry body Indian Paper Manufacturers Association (IPMA), paper consumption in India is projected to grow by 6-7% per annum in the next five years so as to reach 30 million tonnes by the financial year 2027, making it the fastest growing paper market in the world.

The paper industry in the country has undergone a transformation of sorts in the last few years. The industry has gone up the sustainability curve and has become far more technologically advanced.

In the last five to seven years, an amount of over Rs 250 bn has been invested in new efficient capacities and induction of clean and green technologies.

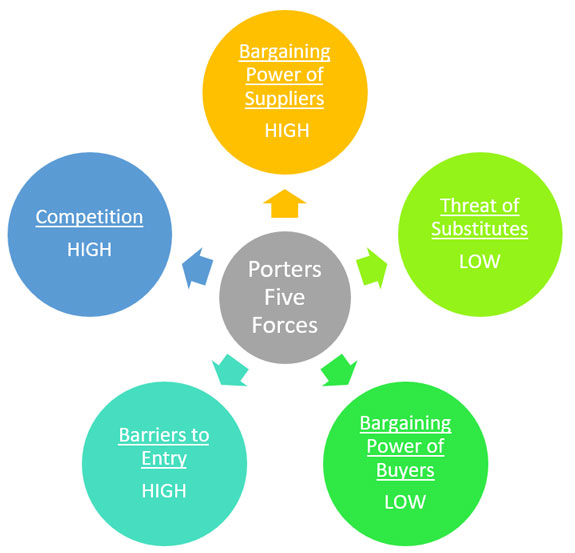

Porter’s Five Forces Analysis of the Paper Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the paper sector -

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the paper sector, barriers to entry are high, owing to availability of raw material, high capital investment, technical expertise and know-how.

#2 Bargaining Power of Suppliers

The bargaining power of customers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

This is high in the paper industry. As raw material pulp is scarce in quantity, suppliers are more powerful in this industry.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the paper sector, the bargaining power of customers is low, as demand far exceeds supply.

#4 Competition

For most industries, having an understanding of the competition is vital to successfully marketing a product.

The competition in the paper industry is high, as the market concentration is high due to large number of big players having considerable market share.

Even the biggest players have found it tough to remain resilient in this highly competitive and commoditized industry.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

This is low for the paper industry as the presence of substitutes and complements has little impact on the industry.

The substitute for writing paper can be Microsoft Office and other electronic writing devices but these substitutes can pose little or no threats to the writing paper. Similarly, for packaging, plastics can act as a substitute.

But plastics can never pose threat to the packing paper as the introduction of plastics and polyethylene has been widely discouraged by the government and is supposed to be banned wholly due to its harmful effect on the nature and environment.

Porters Five Forces Analysis of the Paper Sector in India

When to Invest in Paper Stocks

The paper sector in India offers little reason for investors to be enthusiastic.

This is because the industry is highly competitive. Even the biggest players have found it tough to remain resilient in this highly competitive and commoditized industry.

Among other factors, the paper sector stocks are cyclical owing to the long gestation period in capacity addition and lead time for raw material generation.

The increased competition restricts the ability to pass on the increasing input costs to consumers.

Therefore, the best time to buy stocks from the paper sector is when companies that have strong fundamentals are trading at attractive valuations.

However, there remains a concern that paper stocks could be in danger as digitisation takes over.

Key Points to Keep in Mind While Investing in Paper Stocks

Here are some key points to take note of before you invest in paper stocks.

#1 Wood Pulp and Coal Prices

According to market experts, raw materials and power account for 75% of the expenses of paper manufacturers.

If paper companies are unable to pass on the increase in these costs to consumers, it can result in severe margin compression.

One of the key things to keep in mind before investing in a paper company is if it can generate own power. If yes, you must see if it has a purchase agreement with a domestic supplier such as Coal India so that its dependence on imported coal, which is 30-40% more expensive, is low.

#2 Profitability of the company

Profitability is the primary goal of all business ventures. Without profitability the business will not survive in the long run. So, measuring current and past profitability and projecting future profitability is very important.

Here’s a list of top paper companies in India based on their consolidated net profit.

| Company Name | Net Profit (Rs in m) | Net Profit Margin (%) |

|---|---|---|

| JK Paper Ltd. | 5,111 | 12 |

| West Coast Paper Mills Ltd. | 2,181 | 11 |

| Andhra Paper Ltd. | 1,397 | 10.1 |

| Emami Paper Mills Ltd. | 1,148 | 5.9 |

| Seshasayee Paper and Boards Ltd. | 1,031 | 7.3 |

| Satia Industries Ltd. | 1,007 | 9.6 |

| NR Agarwal Industries Ltd. | 610 | 3.8 |

Data as of March 2022

#3 Debt to equity (D/E) ratio

A company uses both equity and debt to run a business. However, the amount of debt it uses indicates its fixed obligations. Higher the leverage, higher will be the fixed charges such as interest expense which will lower the profitability.

One must look for a debt to equity ratio of one or less than one.

Here’s a list of top paper companies in India with a low debt to equity ratio.

| Company Name | D/E Ratio |

|---|---|

| Hi-Tech Winding Systems Ltd. | 0 |

| Soma Papers & Industries Ltd. | 0 |

| Star Paper Mills Ltd. | 0 |

| Universal Enterprises Ltd. | 0 |

| Seshasayee Paper and Boards Ltd. | 0 |

| Gratex Industries Ltd. | 0.04 |

| Andhra Paper Ltd. | 0.05 |

| Orient Paper & Industries Ltd. | 0.13 |

| Worth Peripherals Ltd. | 0.14 |

| Pudumjee Paper Products Ltd. | 0.21 |

| Ruchira Papers Ltd. | 0.22 |

| B&A Packaging India Ltd. | 0.23 |

| Shree Ajit Pulp & Paper Ltd. | 0.24 |

| Perfectpac Ltd. | 0.24 |

Data as of March 2022

#4 Return on Capital Employed (ROCE) ratio

Along with a low debt to equity ratio, a one must look for a high return on capital employed (ROCE).

Return on capital employed measures how much profits the company is generating through its capital. The higher the ratio, the better.

An ROCE of above 15% is considered decent for companies that are in an expansionary phase.

Here’s a list of top paper companies in India with more than 15% in ROCE.

| Company Name | ROCE (%) |

|---|---|

| B&B Triplewall Containers Ltd. | 28.6 |

| Yash Pakka Ltd. | 25.5 |

| B&A Packaging India Ltd. | 23.9 |

| Worth Peripherals Ltd. | 19.3 |

| Shree Ajit Pulp & Paper Ltd. | 18.4 |

| Ellora Paper Mills Ltd. | 18.3 |

| NR Agarwal Industries Ltd. | 18.1 |

| Andhra Paper Ltd. | 18 |

| Vapi Enterprise Ltd. | 17 |

| Satia Industries Ltd. | 16.5 |

| JK Paper Ltd. | 16.4 |

| Emami Paper Mills Ltd. | 16.4 |

Data as of March 2022

#5 Valuations

Investing in stocks requires careful analysis of financial data to find out a company's true worth. However, an easier way to find out about a company's performance is to look at its financial ratios.

The commonly used financial ratios used in the valuation of paper stocks are -

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out our list of stocks according to their P/BV Ratios.

Price to Earnings Ratio (P/E) - It compares the company’s stock price with its earnings per share. The higher the P/E ratio, the more expensive the stock.

To find stocks with favorable P/E Ratios, check out our list of stocks according to their P/E Ratios.

#6 Dividend yields

There is no consistent trend of dividends across the industry, with different companies having different dividend policies.

For more details, check out our list of top paper stocks offering high dividend yields.

Top Paper Stocks in India

The top paper stocks in India can immensely benefit with so many factors positively affecting the industry.

Here are the top stocks in India which score well on crucial parameters.

Then there’s also ITC, which has a paper segment generating around 10% of its revenues.

ITC is among the top players in the specialty paper space and the market leader in the value added paperboards segment. Its paper division has also been producing biodegradable and recycled boards that can be used by the food and beverage industry as a replacement for single use plastics.

List of Paper Stocks in India

The details of listed paper companies can be found on the NSE and BSE website. However, the overload of financial information on these websites can be overwhelming.

For a more direct and concise view of this information, you can check out our list of paper stocks.

Best Sources for Information on the Paper Sector

Central Pulp and Paper Research Institute -https://cppri.res.in/home-overview

Indian Paper Manufacture Association - https://ipmaindia.org/

Indian Brand Equity Foundation Paper & Packaging Sector Report - https://www.ibef.org/blogs/india-s-paper-and-packaging-industry

So, there you go. Equitymaster's detailed guide on the best paper stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

Here's a list of articles and videos on the paper sector and top paper stocks in India. This is a great starting point for anyone who is looking to explore more about agriculture stocks and the agriculture sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() Bulk Deal Alert: Radhakishan Damani Sells Over 290,000 Shares of Andhra Paper

Bulk Deal Alert: Radhakishan Damani Sells Over 290,000 Shares of Andhra Paper

Feb 6, 2024

Radhakishan Damani sold 299,296 shares of this paper stock via a bulk deal, taking the stock down over 9% in intraday trade.

![]() Paper Stocks: Resumption of the Bullish Trend

Paper Stocks: Resumption of the Bullish Trend

Aug 22, 2023

What do the charts say about investing in paper stocks? Find out...

![]() Bonus Shares Alert: This Paper Stock to Trade Ex-Bonus Soon

Bonus Shares Alert: This Paper Stock to Trade Ex-Bonus Soon

Sep 23, 2022

This small-cap stock is set to issue bonus shares next month.

![]() Why Paper Stocks are Rising

Why Paper Stocks are Rising

Mar 15, 2022

Most paper stocks are trading near their 52 week highs or are just breaking out of a consolidation range.

![]() Radhakishan Damani Books Profit in Smallcap Paper Stock

Radhakishan Damani Books Profit in Smallcap Paper Stock

Oct 9, 2023

This paper stock has surged over 40% in the past three months.

![]() This Ignored Sector Could Produce the Next Multibagger Stock

This Ignored Sector Could Produce the Next Multibagger Stock

Sep 26, 2022

Stocks in this sector could do well in the near term owing to strong demand. Find out other tailwinds affecting the sector, and which stocks to watch out for.

![]() Paper Stocks Are on Fire

Paper Stocks Are on Fire

Mar 16, 2022

Paper Stocks are looking bullish on the charts. Should you trade them? Watch this video first...

![]() Is the Paper Sector on the Path of Recovery?

Is the Paper Sector on the Path of Recovery?

Jul 13, 2021

The country's paper sector expects a revival of demand from the current half of the calendar year 2021.