- Home

- Todays Market

- Indian Stock Market News October 19, 2020

Four Reasons Why Sensex Zoomed 448 Points Today Mon, 19 Oct Closing

Indian share markets continued their momentum throughout the day today and ended on a strong note.

Here are five factors behind today's stock market rally:

Positive Global Cues: Benchmark indices edged higher today tracking gains in Asian peers which rose on hopes of a new US coronavirus relief deal before the presidential election.

House Speaker Nancy Pelosi said on Sunday that differences remained with President Donald Trump's administration on a wide-ranging coronavirus relief package but that she was optimistic legislation could be pushed through before the presidential election.

China's Economic Recovery: Sentiment also got a boost after a government-appointed panel on October 18 said the COVID-19 pandemic had peaked in India and could be brought under control by early next year with minimal active cases by February-end if protective measures are followed. Media reports also suggested that China's economic recovery quickened in the third quarter even as overall growth missed the forecast.

Coronavirus Vaccine Updates: Boosting overall sentiment, drug maker Pfizer Inc said on Friday it could have a coronavirus vaccine ready in the United States by the end of this year.

Gains in the Banking Sector: Benchmark indices got a boost from banking stocks that rallied today after the Q2FY21 results of HDFC Bank cheered investors. HDFC Bank, the country's largest private sector lender, reported an 18.4% year-on-year (YoY) growth in profit for the September quarter.

At the closing bell, the BSE Sensex stood higher by 448 points (up 1.1%).

The NSE Nifty closed higher by 110 points (up 0.9%).

ICICI Bank and Nestle were among the top gainers today.

The SGX Nifty was trading at 11,909, up by 137 points, at the time of writing.

The BSE Mid Cap index ended up by 0.6%.

The BSE Small Cap index ended up by 0.4%.

On the sectoral front, gains were largely seen in the banking sector and finance sector.

Asian stock markets ended on a mixed note. As of the most recent closing prices, the Hang Seng ended up by 0.64% and the Shanghai Composite ended down by 0.71%. The Nikkei up by 1.11%.

The rupee is trading at 73.33 against the US$.

Gold prices are trading up by 0.5% at Rs 50,798 per 10 grams.

Speaking of stock markets, the stock of ITC is a hot potato these days. There are investors who are unhappy with the company's management and wants them to pull up their socks. And then there are investors who believe that we need to be patient and that the company is on the right track.

What should investors do in light of these differences and how HUL's performance in the past could hold the key to ITC's future?

Rahul Shah answers these questions and more in his latest video.

Tune in here to know more:

Moving on, as per an article in The Economic Times, government has asked public sector units (PSUs) with a stock price higher than the book value to reward shareholders.

The article further added that up to 8 companies including Coal India, NTPC, NMDC and Engineers India may consider buyback of shares soon.

The government is looking to boost divestment proceeds via buybacks. It has asked public sector units to either buyback shares or spend on capital expenditure.

In news from the banking sector, banking stocks witnessed buying interest today after HDFC Bank and Federal Bank reported a healthy operational performance for July-September 2020 quarter of the current fiscal (Q2FY21).

Shares of ICICI Bank, Axis Bank, Bandhan Bank and RBL Bank from the Nifty Bank index gained in the range of 3-5%.

Federal Bank reported a 26.2% year-on-year (YoY) decline in September quarter profit, impacted by significant step up in provisions to further strengthen the balance sheet.

Net interest income surged 22.8% YoY to Rs 13.8 billion with muted loan growth of 6% YoY and net interest margin at 3.13% for the quarter.

Deposits grew 12% in the quarter under review.

The asset quality of the bank improved during the quarter. The gross NPAs declined to 2.84% in Q2FY21, from 3.07% in Q2FY20.

The GNPAs were at 2.96% at end of Q1FY21. Net NPAs were at 0.99% in September 2020, down from 1.59% in September 2019.

Federal Bank share price ended the day up by 7%.

Moving on to news from the finance sector, Dewan Housing Finance Corporation (DHFL) was among the top buzzing stocks today.

DHFL share price was locked in 10% upper circuit at Rs 13.87 on the BSE on reports that Adani and Piramal were among four bids for the troubled non-banking finance company (NBFC).

"The Administrator of the Company has received four (4) resolution plans with respect to the options given to the Prospective Resolution Applicants (PRAs) as per the Invitation for Expression of Interest for Submission of Resolution Plan for DHFL dated 28th January 2020," the company said in an exchange filing on Sunday.

Reports state that four entities - Adani Group, Piramal Group, US-based asset management company Oaktree Capital Mangement, and SC Lowy have submitted bids for DHFL.

While Oaktree submitted a bid for the entire company, others bid for select portfolios.

Adani Group has submitted bids only for the construction finance portfolio and slum rehabilitation loans, while Piramal Group has bid for the retail portfolio, and SC Lowy for the construction finance business, putting it in competition with Adani Group.

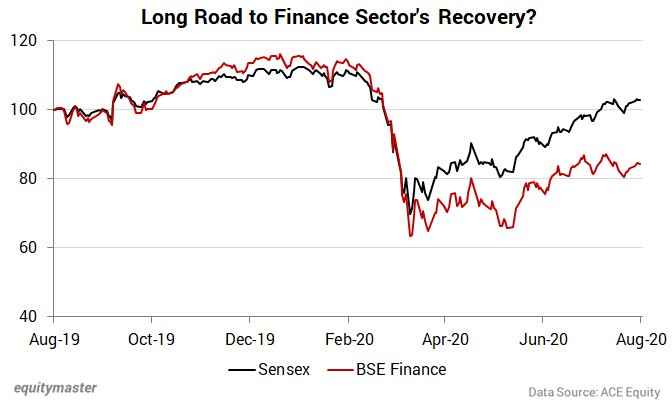

Speaking of the banking and finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Four Reasons Why Sensex Zoomed 448 Points Today". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!